Executive Summary

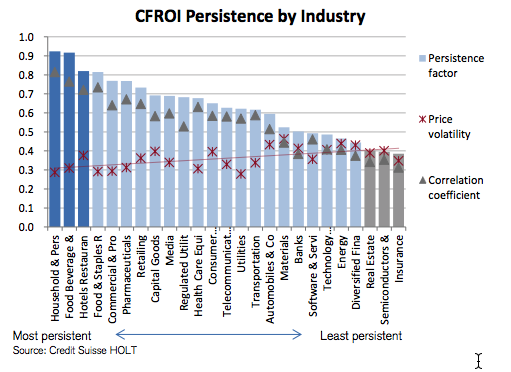

The Credit Suisse research team is one of my favourites as they always publish interesting papers. In this paper, the authors wanted to look at the stickiness of corporate profitability. They found that good companies tend to remain good companies, poor companies tend to remain mediocre. They also found that the reputation of businesses tend to remain intact regardless of industry and companies with an operational edge tend to maintain it, while those without an edge will do the same operational mistakes all over again. Furthermore, companies in defensive industries (Household & Personal products, Food & Beverage, etc.) tend to have more corporate profitability stickiness than firms in cyclical or fast-changing industries.

The implication for managers and investors is to be aware that corporate turnarounds are difficult to execute and the odds of success are low. They need to be wary of overpaying for poor assets. As Warren Buffett once said: “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Distinguishing Good Companies from Poor Companies

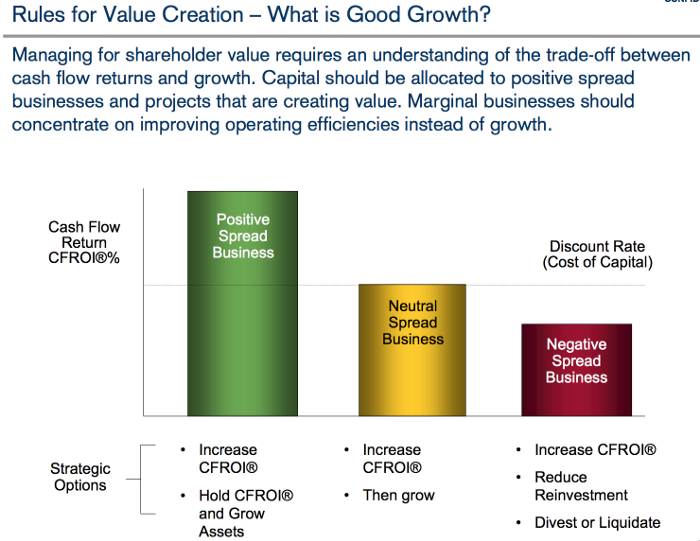

The Credit Suisse team uses a financial ratio called CFROI which is an inflation-adjusted cash flow return on operating assets (Free Cash Flow/Invested Capital). Executives and investors can compare this metric to a cost of capital, adjusted for inflation, to distinguish if the firm is creating or destroying value. It is important to note that it is not earnings growth that matters but the quality of the growth. Firms with a CFROI exceeding its cost of capital should focus on reinvestment and growth whereas firms with a CFROI at or below their cost of capital should focus on managing and leveraging key value drivers.

The Credit Suisse team defines greatness as “the ability to generate excess economic profits compared to rivals over sustained periods.” Although the economics of a business have a large impact on its ability to generate excess profits, management still have an important role as their cumulative small decisions have a compounded effect on corporate performance over time. While great brands can be destroyed by poor management decisions, executives and investors should look for strong culture, because it acts as a defence mechanism against incompetent management.

Conclusion

Given that corporate profitability is sticky and that great firms tend to have an operational and reputation edge, executives and investors must be aware that it is extremely difficult to transform a poor business into a great business. As we explored in To Buy or Not To Buy: A Checklist for Assessing Mergers & Acquisitions, people tend to overestimate their ability to manage assets of a firm more efficiently than the current management, which lead to overestimating the value of assets and poor returns.

If executives and investors want to generate outsized returns, they can try to buy high quality firms at a fair price. However, it is easier said than done as other investors are looking for the same kind of assets. Sometimes, high quality firms might get in trouble. Once these high quality firms get in trouble, the only things left are culture and fundamental economics. While fundamental economics can be evaluated through a bottom-up analysis, culture is harder to evaluate. In The Link Between Corporate Purpose and Financial Performance, we saw that high purpose/high management clarity firms (e.g. “Management makes its expectations clear”; “Management has a clear view of where the organization is going and how to get there”) generated significant abnormal stock returns and thus we should expect reversion to the mean with these kinds of companies.

Read more: Was Warren Buffett Right: Do Wonderful Companies Remain Wonderful? by Matthews B. & Holland D. (2013) — Credit Suisse