Executive Summary

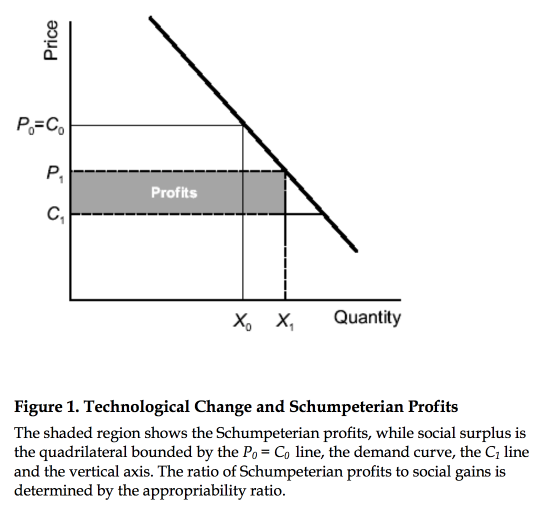

We live in an era of rapid technological changes, which some people call the “new economy.” The new economy is the result of the transition from a manufacturing-based economy to an economy where companies that are on the cutting edge of technology are the driving force of economic growth. Some investors believe that new economy companies can transform innovations into massive profits and high stock values. As such, the author defines the notion of Schumpeterian profits as “those profits that arise when firms are able to appropriate the returns from innovative activity.”

By investigating if innovators are able to capture a significant fraction of the benefits from technological advances, the author found that only a small fraction of the social returns was captured by producers. Thus, most of the benefits from innovations are passed on to consumers rather than captured by producers.

Model of Appropriability and Schumpeterian Profits

As I wrote in another PNR Paper, competitive advantage through continuous innovation is one of the bases of corporate success. But innovation must be appropriable, meaning that firms need to be able to retain the added value it creates for its own benefit. Competitive advantage can be built through legal ownership of intellectual property rights (patents, copyrights, trademarks), through trade secrets or early-mover advantages.

The hope for these innovators is that some of these innovative activities produce Schumpeterian profits (extra-normal profits), which are “profits above those that would represent the normal return to investment and risk-taking.” However, it is well known that innovators do not generally capture the entire value of their activities as the innovation is diffused and reduces the cost of producing a good or a service.

The Dynamic of Schumpeterian Profits

In most industries, there is a stream of innovations. Some of the innovations are in the public domain and go directly to a reduction in the cost of production because they are inappropriable. For innovations where costs reductions are partially appropriated, the innovators will have temporary increases in profits. Over time, there is an erosion of these profits because of expiration/non-enforcement of patents, the ability of others to imitate and the loss of market power. According to the results of the author, the initial appropriability ratio is around 10% with a depreciation rate of around 20% per year which means that firms should only be able to capture 1.6% of the profits from their innovation after a decade.

The New Economy and the Alchemist Fallacy

The author found that the appropriability ratio for cutting-edge/high-growth firms was 6% with a depreciation rate of 20%. The appropriability in the new economy is not significantly different from the old economy. In the new economy, because of the nature of the firms and of the industry, it is to be expected that firms will not be able to generate high Schumpeterian profits. New economy firms are involved in the acquisition, processing, transformation and distribution of information. By its nature, the value from information is hard to appropriate as it is expensive to produce and inexpensive to reproduce. As such, the low cost of imitation, transmission and distribution of information reduces the durability of Schumpeterian profits in the new economy.

Given the results of the paper, investors and innovators must not succumb to the alchemist fallacy. Alchemy was an ancient art based on the supposed transformation of matter (i.e. transmuting common metals into gold). The alchemist fallacy is to think that, once a process was found to transform any matter, the transformed matter would retain its scarcity, and the discoverers would be immensely rich. However, the laws of economics are a safer bet as they teach us that if such process was found, the transformed matter would quickly fall as it would become as common and cheap as other matters.